This typically includes responsibility for acceptability of the specified good or service (for example, primary responsibility for the good or service meeting customer specifications).

Investments in debt and equity securities (pre ASU 2016-13) Revenue from contracts with customers (ASC 606)Įquity method investments and joint ventures

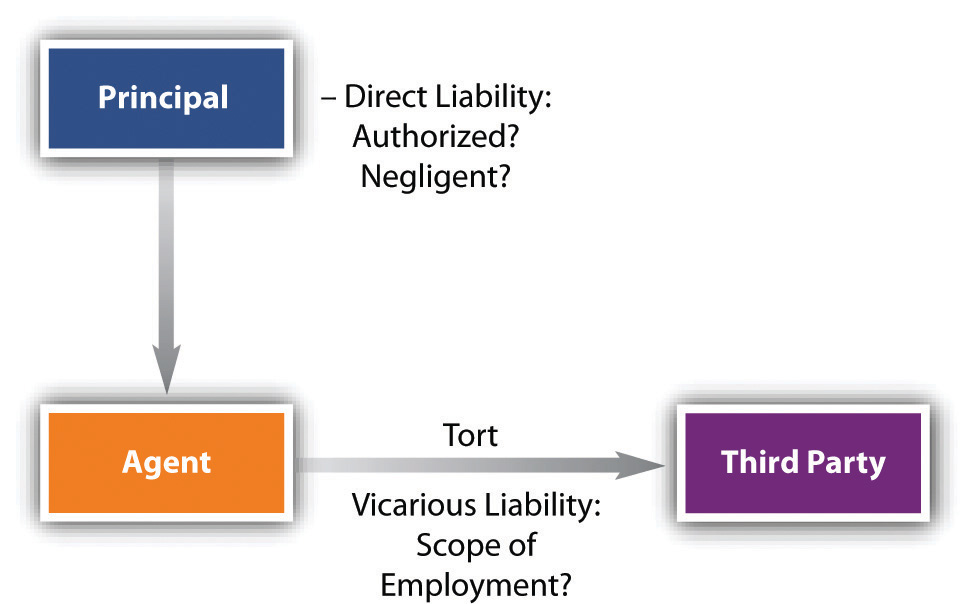

Insurance contracts for insurance entities (pre ASU 2018-12) Insurance contracts for insurance entities (post ASU 2018-12) It is one of the most noticed problems in the current situation when most companies are not being managed by the owners themselves.IFRS and US GAAP: Similarities and differencesīusiness combinations and noncontrolling interests This can lead to principle agent problem. But the managers sensing their own growth and salary expectation try to retain the profits for future as a safe side. The shareholders expect the managers to distribute all the profits to the shareholders. Owing to the costs incurred, the agent might begin to pursue his own agenda and ignore the best interest of the principle, thereby causing the principal agent problem to occur.ĭescription: The costs to agent and subsequent conflict of interest arise due to the skewed information symmetry and the risk of failure faced by the principal.įor example: Shareholders of a company appoint managers to look after the proceedings of the company and earn profits on their behalf. Such an agreement may incur huge costs for the agent, thereby leading to the problems of moral hazard and conflict of interest. Definition: The principle agent problem arises when one party (agent) agrees to work in favor of another party (principle) in return for some incentives.

0 kommentar(er)

0 kommentar(er)